Families across Kentucky and Tennessee face a period of deep uncertainty as health insurance premiums rise at a pace many find alarming. Residents in counties across Appalachia feel the impact in their household budgets as they prepare for the coming open enrollment cycle. Premiums that once felt manageable now surge to levels that create anxiety and confusion. Many people who believed their coverage was secure now confront a new landscape shaped by federal policy shifts, medical inflation, and market forces that place even greater strain on communities that have long struggled with limited access to care.

The primary force behind these steep increases is the expiration of the enhanced premium tax credits created through the American Rescue Plan Act. Those credits lowered the amount marketplace enrollees paid every month for coverage. They expanded financial help for many households with modest incomes and allowed even middle-income families to secure comprehensive plans at prices they could afford. The credits also opened the door to coverage for many who had never before enrolled in a marketplace plan because of cost barriers. Their end removes a powerful stabilizer in the region’s insurance markets.

When the enhanced credits disappear, the portion of the premium paid directly by consumers rises sharply. This sudden shift happens at the same time insurers forecast higher base premiums driven by medical inflation. Health systems report higher costs for labor, equipment, hospital stays, and prescription drugs. Insurers reflect those costs in the prices they file for the upcoming year. Families in Appalachia therefore experience two waves of financial pressure. The amount they owe grows because financial assistance shrinks, and the original cost of coverage grows at the same time.

This combination hits Kentucky and Tennessee especially hard. Many residents in both states rely heavily on marketplace coverage due to limited access to employer plans and the absence of Medicaid expansion in Tennessee. With the expiration of the enhanced credits, Kentucky families who once paid moderate amounts each month now report increases of several hundred dollars. Tennessee families face similar jumps. Some individuals describe increases large enough to force them to rethink coverage entirely. The sticker shock lands hardest in rural counties where incomes remain modest and medical access has always been fragile.

The question many residents ask is why this moment arrived. The answer lies in policy decisions made when the enhanced credits were created. Lawmakers designed the expanded financial assistance as a temporary measure meant to provide relief during a period of economic upheaval. When the time came for Congress to decide whether to extend them, disagreement emerged. Supporters argued that the temporary credits had become essential for millions who depended on them for basic access to coverage. They pushed for an extension that would support families facing rising costs for food, utilities, and medicine. They warned that ending the credits would place families throughout Appalachia in financial jeopardy at a time when wages struggle to keep pace with inflation.

Opponents pointed to the original structure of the program. They argued that temporary measures have an end point and expressed concern about the long-term fiscal impact of extending large subsidy programs indefinitely. They also raised questions about the appropriate role of federal assistance in markets that evolve year by year. With neither side willing to concede ground, Congress failed to reach agreement. As a result, the credits expire, leaving consumers to face the consequences in real time.

The premium increases produce a cascade of unintended outcomes that extend far beyond the marketplace itself. One of the most significant effects is a rise in the number of uninsured residents. Analysts forecast increases of hundreds of thousands in Kentucky and Tennessee combined. These numbers represent families who must choose between health insurance and essential household costs. Many will go without coverage simply because they cannot absorb the new premiums.

The rise in the uninsured population produces another consequence. Hospitals and clinics across Appalachia already carry a heavy burden of uncompensated care. When more patients arrive without coverage, the pressure grows. In rural communities where hospitals operate with narrow margins, increases in uncompensated care can threaten the survival of entire facilities. When a hospital in a small-town closes or reduces services, the surrounding region experiences deep and lasting harm. Emergency care becomes more distant. Routine care becomes harder to access. Health outcomes decline. The premium increases therefore reach far beyond household budgets and touch the entire healthcare ecosystem.

Another ripple effect occurs within the insurance market itself. When premiums rise sharply, healthier individuals often choose to leave the marketplace. They feel confident they can go without coverage for a period and use the money saved for other expenses. When healthier individuals exit, the risk pool becomes older and sicker on average. Insurers then face higher expected claims and raise premiums again. This cycle can destabilize the market over time and make insurance even more expensive for those who remain. Appalachia already struggles with higher rates of chronic illness, which increases the chance that premiums will continue to climb as the risk pool shifts.

For individuals and families navigating this environment, practical steps can ease some of the pressure. One of the most important pieces of guidance is to engage actively with the open enrollment process. Many people allow their plans to renew automatically, believing this saves time. In a year with steep increases, this choice can lead to unwanted surprises. Comparing plans across multiple insurers can reveal options with lower premiums or more favorable cost structures.

Some consumers may consider moving from a silver plan to a bronze plan. Bronze plans carry lower monthly premiums in exchange for higher deductibles and out of pocket costs. This approach can help households with few medical needs maintain coverage while keeping monthly expenses controlled. It also creates eligibility for a Health Savings Account if the plan meets the required deductible level. An HSA provides a way to set aside money for medical expenses while lowering taxable income. Families who can contribute to an HSA may reduce their overall financial burden even if their plan carries higher deductibles.

Consulting with a licensed insurance agent can also provide value. Agents’ familiar with Kentucky and Tennessee marketplaces understand how plans differ by county, which networks include local hospitals, and which insurers offer strong customer service. They can help families weigh tradeoffs between premium levels, deductibles, prescription coverage, and provider access.

The story of rising premiums in Appalachia also presents a powerful opportunity for reporters. Clear and empathetic storytelling can bring attention to the challenges of families in the region. Beginning with a vivid account of a household facing a sudden premium jump can draw readers into a broader exploration of the issue. Reporters can then explain the policy changes that created the situation, followed by an examination of community wide consequences. Concluding with guidance for residents and a call for continued public discussion gives readers a path forward.

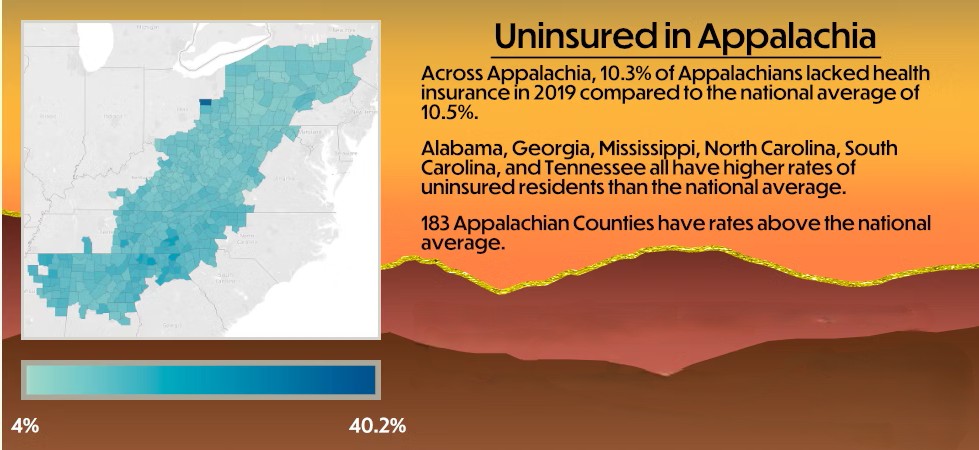

Because the numbers involved can feel abstract, visual elements can play an important role. Charts that translate percentage increases into actual monthly costs help readers understand how premiums rise for different ages, incomes, and household sizes. Maps comparing counties across Appalachia illuminate the uneven impact. Interactive tools help households estimate their own potential costs. When combined with clear explanations of terms like enhanced premium tax credits, subsidies, ACA marketplace, and benchmark plans, these visuals bring clarity to a complex topic.

Balanced reporting also matters greatly. While the political disagreement in Congress contributes directly to the current crisis, journalists can present the arguments from each side with care and accuracy. This approach ensures credibility while still highlighting the real-world implications of policy decisions. Strong language that conveys the severity of the situation can coexist with objectivity. Words such as sticker shock or skyrocket describe the experience of families while still maintaining a factual tone.

For communities across Appalachia, the coming months carry immense significance. The premium increases will affect health, finances, and access to care. The region stands at a moment that could reshape its insurance landscape for years to come. Whether families can maintain coverage, whether hospitals can continue delivering essential services, and whether policymakers can find common ground will all influence the future of health care in Kentucky and Tennessee.

-Tim Carmichael

Leave a comment